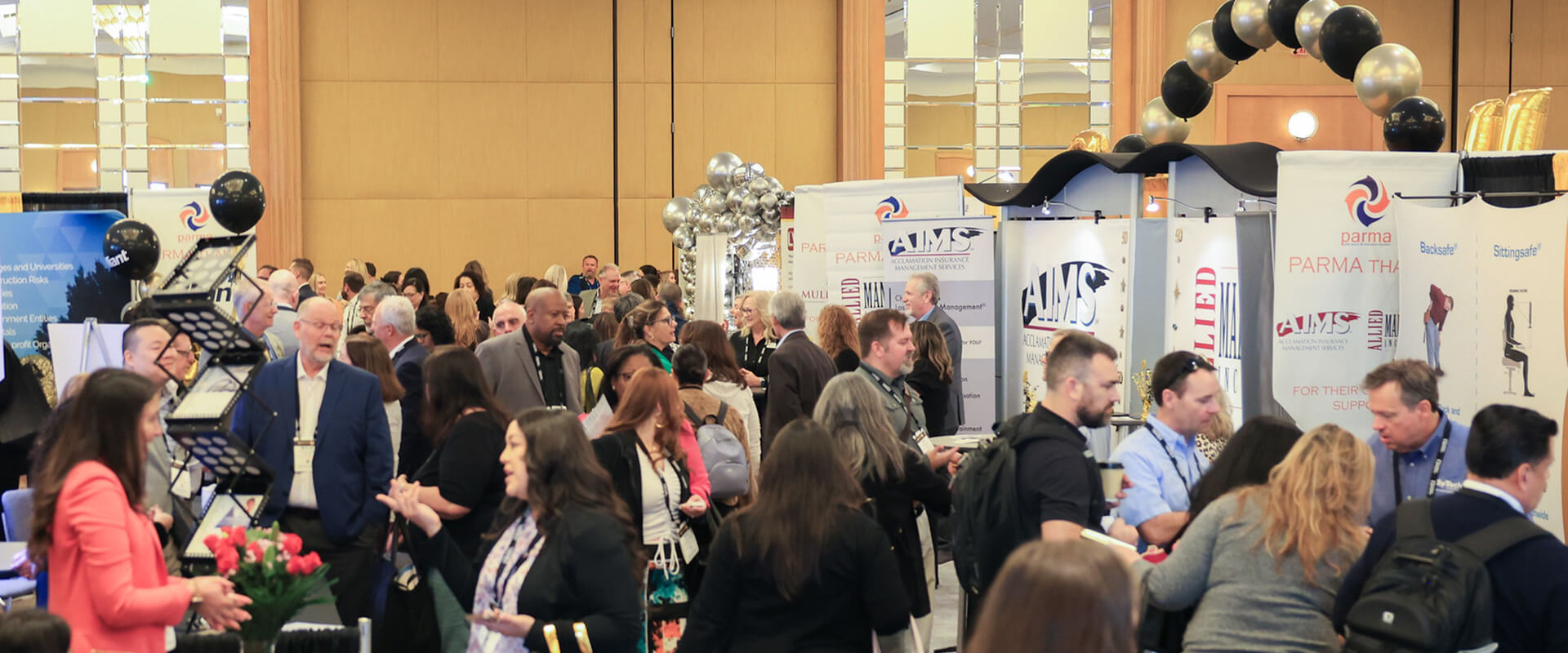

Titanium Sponsor Spotlight - AIMS & AMC

As Titanium sponsors, AIMS and AMC thank PARMA for providing us with a unique opportunity to support PARMA in their mission to provide a forum for California public risk employees to share ideas and solutions in the ever-shifting risk management challenges that exist in today’s environment. Through our sponsorship, we have been given the potential to elevate visibility, forge meaningful connections and networking, build trust, contribute to societal well-being, achieve returns that exceed far beyond financial metrics, and establish ourselves as industry thought leaders and authorities. Through